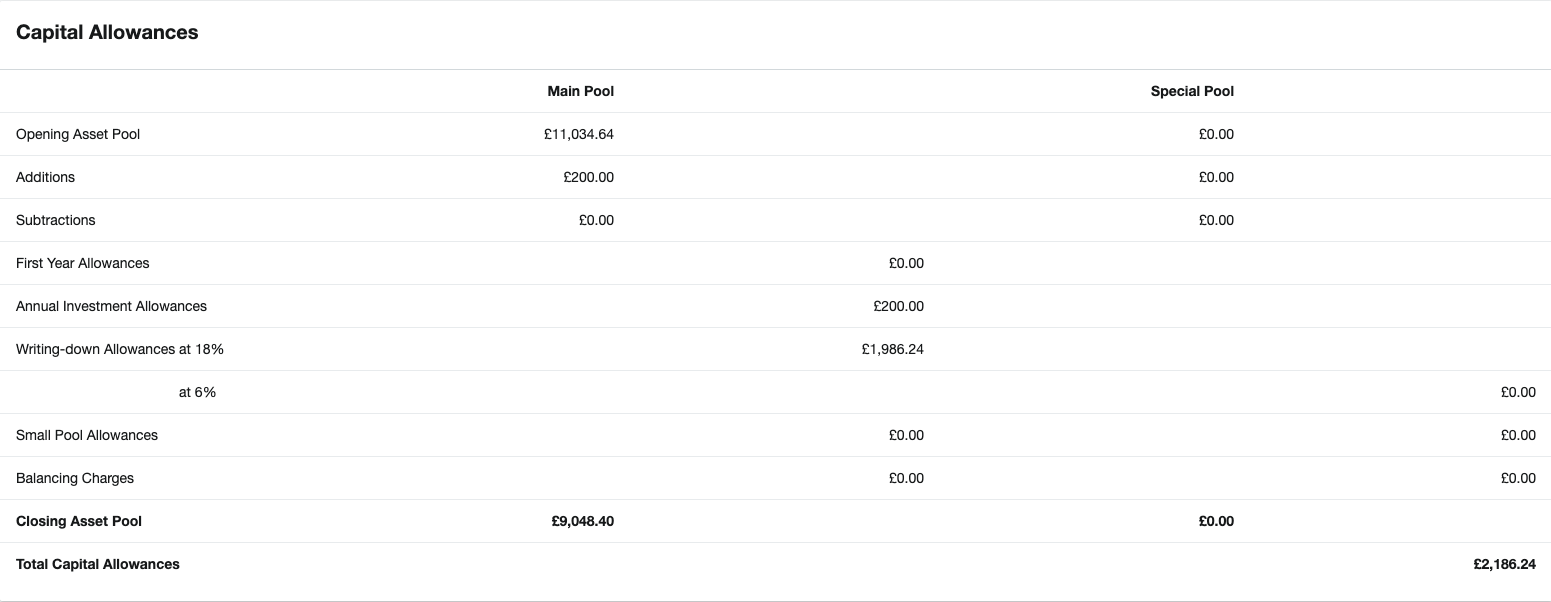

Capital Allowances - Plant & Machinery 2018/19 - ABAC Chartered Accountants Omagh, Tyrone, Northern Ireland

Capital Allowances - Plant & Machinery 2018/19 - ABAC Chartered Accountants Omagh, Tyrone, Northern Ireland

taxes - Capital allowance and balancing charges on UK tax return - Personal Finance & Money Stack Exchange

Balancing Adjustments on Pools and Review of Capital Allowance Computation – ACCA Taxation (TX-UK) - YouTube